As decentralized finance (DeFi) continues to revolutionize the crypto landscape, liquidity mining has emerged as a popular way for users to earn rewards by providing liquidity to decentralized exchanges.

Biswap Exchange, operating on the Binance Smart Chain (BSC), offers a unique liquidity mining program that allows users to contribute to the platform’s liquidity pools and earn rewards.

In this comprehensive guide, we will walk you through the step-by-step process of liquidity mining on Biswap, exploring the key concepts, benefits, and strategies to maximize your earnings.

Understanding Liquidity Mining on Biswap

Liquidity mining, also known as yield farming, involves users providing liquidity to a decentralized exchange in the form of cryptocurrency tokens. In return for contributing to the liquidity pools, users receive rewards in the form of additional tokens issued by the platform.

Biswap employs liquidity mining to incentivize users to supply liquidity to its various trading pairs, enhancing the efficiency of the exchange.

Essentially what you are doing is providing 2 coins that can be traded on the exchange, and you will receive a share of the profits generated when those coins are traded.

The more funds you deposit, the bigger share of the pool you will have, and the more of the profits generated you will receive.

Step-by-Step Guide to Earning Money

Through Liquidity Mining on Biswap

1. Set Up a BSC-Compatible Wallet: To participate in Biswap’s liquidity mining, you need a BSC-compatible wallet. Popular options include MetaMask or Trust Wallet. Ensure your wallet is configured to the Binance Smart Chain network.

2. Get BNB (Binance Coin): Biswap operates on the Binance Smart Chain, and BNB is often used for transaction fees and interacting with smart contracts. Acquire BNB on a supported exchange and transfer it to your BSC-compatible wallet.

3. Convert BNB to Desired Tokens: Before you can participate in liquidity mining, you need to obtain the tokens you wish to contribute to the liquidity pools. Use the PancakeSwap decentralized exchange or another BSC-compatible exchange to convert some of your BNB to the desired tokens.

4. Navigate to Biswap Exchange: Visit the Biswap Exchange website and connect your BSC-compatible wallet. Make sure your wallet is set to the Binance Smart Chain network.

5. Access the “Liquidity” Section: In the Biswap interface, navigate to the “Liquidity” section. Here, you will find a list of available liquidity pools, each representing a trading pair on the platform.

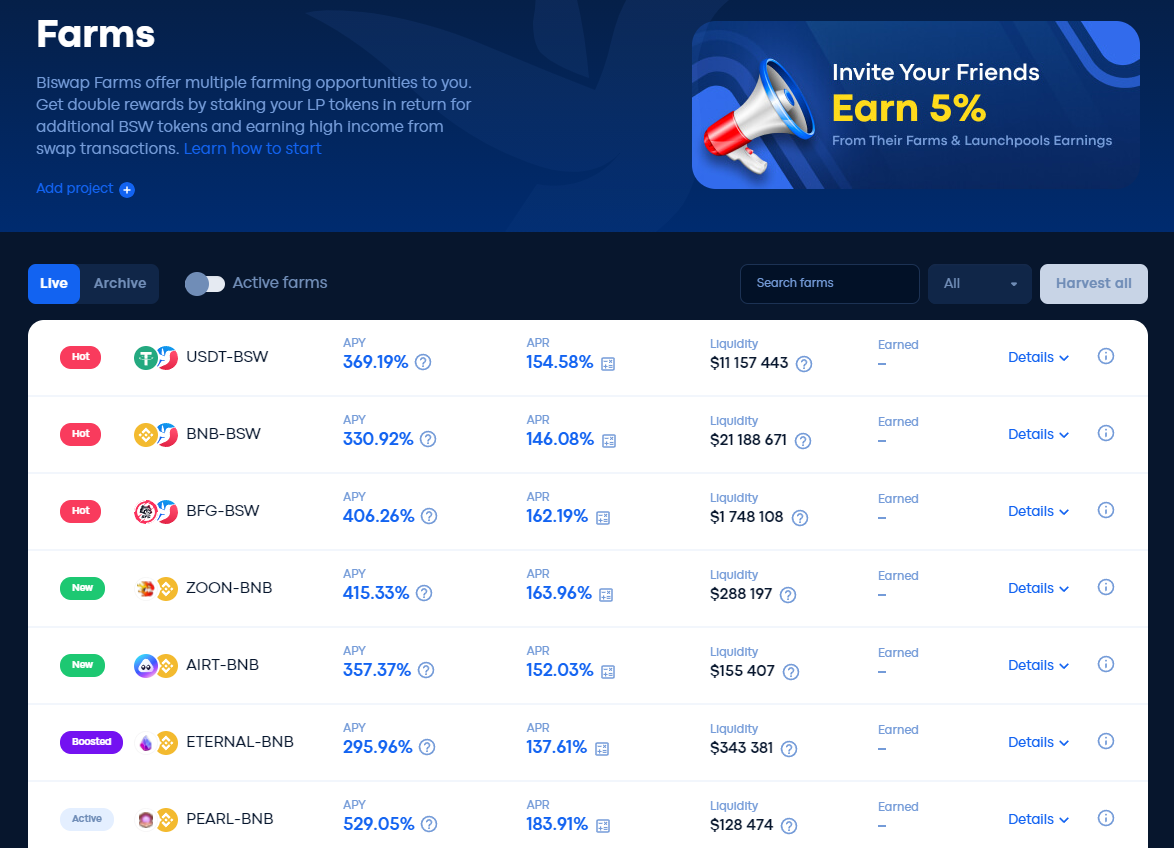

6. Choose a Liquidity Pool: Select the liquidity pool you want to contribute to. Pools often consist of pairs like BNB/BUSD, BNB/ETH, or other popular tokens on the Binance Smart Chain.

7. Add Liquidity to the Pool: Click on the “Add Liquidity” button for your chosen pool. Enter the amounts of both tokens you wish to contribute to the liquidity pool. Biswap will automatically calculate your share of the pool.

8. Review and Confirm: Carefully review the details of your liquidity provision, including the estimated share of the pool and potential rewards. Confirm the transaction in your wallet to add liquidity to the chosen pool.

9. Receive LP (Liquidity Provider) Tokens: In return for your liquidity provision, Biswap mints Liquidity Provider (LP) tokens and sends them to your wallet. These LP tokens represent your share of the liquidity pool and are used to claim your rewards.

10. Monitor Your Position: Keep track of your liquidity provision on Biswap. You can monitor your position, view your earned rewards, and assess the overall performance of your liquidity provision through the platform’s interface.

11. Withdraw Liquidity and Claim Rewards: When you decide to withdraw your liquidity, return to the “Liquidity” section on Biswap and select “Remove Liquidity.” Enter the amount you want to withdraw, and your LP tokens will be burned as you receive the corresponding tokens and any accumulated rewards.

Considerations and Strategies for Maximizing Earnings

1. Choosing the Right Pools: The success of liquidity mining depends on the choice of pools. Consider factors like trading volume, potential rewards, and the popularity of the tokens in the pool. Choosing well-established and high-demand pools can maximize your earnings.

2. Risk Management: Evaluate the potential risks associated with each liquidity pool. Understand the impermanent loss concept, where the value of tokens in the pool may diverge. Diversify your liquidity provision to minimize risk and consider your risk tolerance.

3. Staying Informed: Keep abreast of updates and announcements from Biswap. The platform may introduce new liquidity pools, adjust reward structures, or implement other changes. Staying informed ensures that you can adapt your strategy accordingly.

4. Claiming Rewards Regularly: Rewards earned through liquidity mining need to be claimed periodically. Biswap often distributes rewards on a regular schedule. Set a routine for claiming your rewards to optimize your earnings.

5. Exploring Different Strategies: Biswap may offer additional opportunities for earning, such as yield farming on specific farms or participating in governance. Explore different strategies and diversify your participation in Biswap’s ecosystem to maximize your overall returns.

6. Understanding Vesting Periods: Some rewards on Biswap may have vesting periods, meaning they are locked for a certain duration before becoming fully accessible. Understand the vesting terms associated with your rewards to plan your liquidity provision strategy accordingly.

Liquidity mining on Biswap presents an exciting opportunity for users to earn rewards by contributing to the platform’s liquidity pools.

By following this comprehensive guide and considering the outlined steps, users can navigate the process of liquidity mining on Biswap with confidence. Keep in mind the importance of choosing the right pools, managing risks, and staying informed to optimize your earnings in this dynamic decentralized finance landscape.